how much federal taxes deducted from paycheck nc

How much is taken out of my paycheck for taxes in NC. For tax year 2021 all taxpayers pay a flat rate of 525.

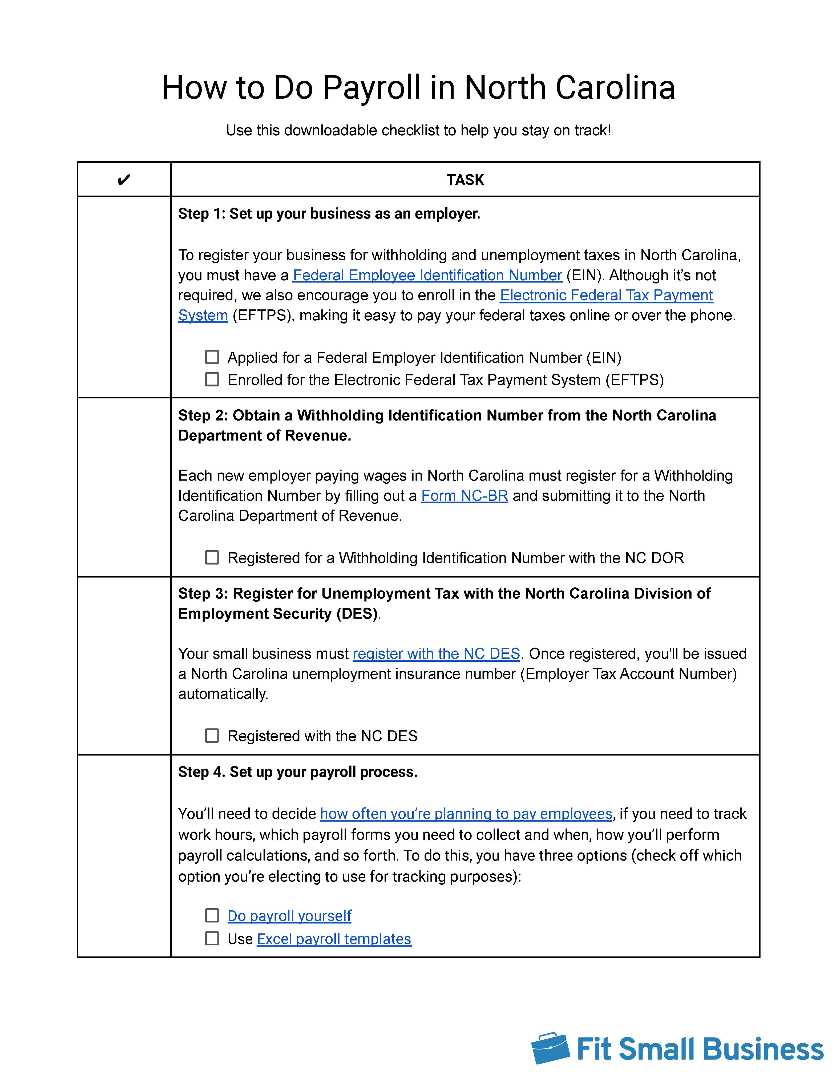

How To Do Payroll In North Carolina Detailed Guide For Employers

Student loan forgiveness can incur federal taxes.

. ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible. Deductions for the employers benefit are limited as follows. The state of North Carolina offers a standard deduction for taxpayers.

Federal Income Tax Withholding. ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible. When you get paid in North Carolina you will notice that money has been withheld from your wages for FICA federal and state income taxes.

Federal Insurance Contributions Act FICA Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. There is a flat income tax rate of 525 which means no matter who you are or how much you make this is the rate that will be deducted. You are able to use our North Carolina State Tax Calculator to calculate your total tax costs in the tax year 202223.

For 2022 its limited to 6 of the first 7000 of an employees wages each year. Ad Compare Your 2022 Tax Bracket vs. Your 2021 Tax Bracket To See Whats Been Adjusted.

A in non-overtime workweeks wages may be reduced to the minimum wage level but cannot go below the minimum wage currently 725 an hour and b during overtime workweeks wages may be reduced to the minimum wage level for the first 40 hours. North Carolina has not always had a flat income tax rate though. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax.

Employee Pay Stub. For North Carolina income tax purposes the charitable contribution limitation is 60. Our online Monthly tax calculator will.

Your employer then will multiply 68076 by 15 percent 10211 and add the 1680 base amount. North Carolina moved to a flat income tax beginning with tax year 2014. North Carolina income tax rate.

North Carolina has a flat income tax rate of 525 meaning all taxpayers pay this rate regardless of. Census Bureau Number of cities that have local income taxes. Plus to make things even breezier there are no local income taxes.

North Carolinas flat tax rate for 2018 is 549 percent and standard deductions were 8750 if you filed as single and 17500 if you were married and filing jointly. For Tax Years 2015 and 2016 the North Carolina individual income. Our calculator has been specially developed in order to provide the users of the calculator with not.

Our online Weekly tax calculator will automatically. Whats New As Of January 1 2021. Many employers will qualify for tax credits to reduce the rate to 06 by paying their state unemployment taxes on time.

And like North Carolina employers are solely responsible for paying FUTA tax. That rate applies to taxable income which is income minus all qualifying deductions and exemptions as well as any contributions to a retirement plan like a 401k or an IRA. Withholding information can be found through the IRS Publication 15-T.

For federal income tax purposes the contribution limitation for cash contributions for tax year 2021 is 100 of an individuals adjusted gross income AGI. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. The income tax is a flat rate of 499.

How Much Does H r Block Charge To Do Taxes. Deduct federal income taxes which can range from 0 to 37. How Your North Carolina Paycheck Works.

However NO deductions can be made from the full. Plus to make things even breezier there are no local income taxes. The only other thing you need to worry about is North Carolina State Unemployment Insurance.

There is a flat income tax rate of 499 which means no matter who you are or how much you make this is the rate that will be deducted. Just enter the wages tax withholdings and other information. To be clear student loan forgiveness wont.

Use ADPs North Carolina Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Medical and Dental Expenses. 2 days agoIf you receive 20000 in tax-free student loan forgiveness youll avoid 2400 in federal taxes.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. The 2021 standard deduction allows taxpayers to reduce their taxable income by. It simply refers to the Medicare and Social Security taxes employees and employers have to pay.

Discover Helpful Information And Resources On Taxes From AARP. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. You are able to use our North Carolina State Tax Calculator to calculate your total tax costs in the tax year 202223.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

2022 Federal Payroll Tax Rates Abacus Payroll

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Paycheck Calculator Smartasset

Payroll Software Solution For North Carolina Small Business

North Carolina Providing Broad Based Tax Relief Grant Thornton

Documents Store Payroll Template Printable Tags Template Money Template

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Income Tax Calculator Smartasset

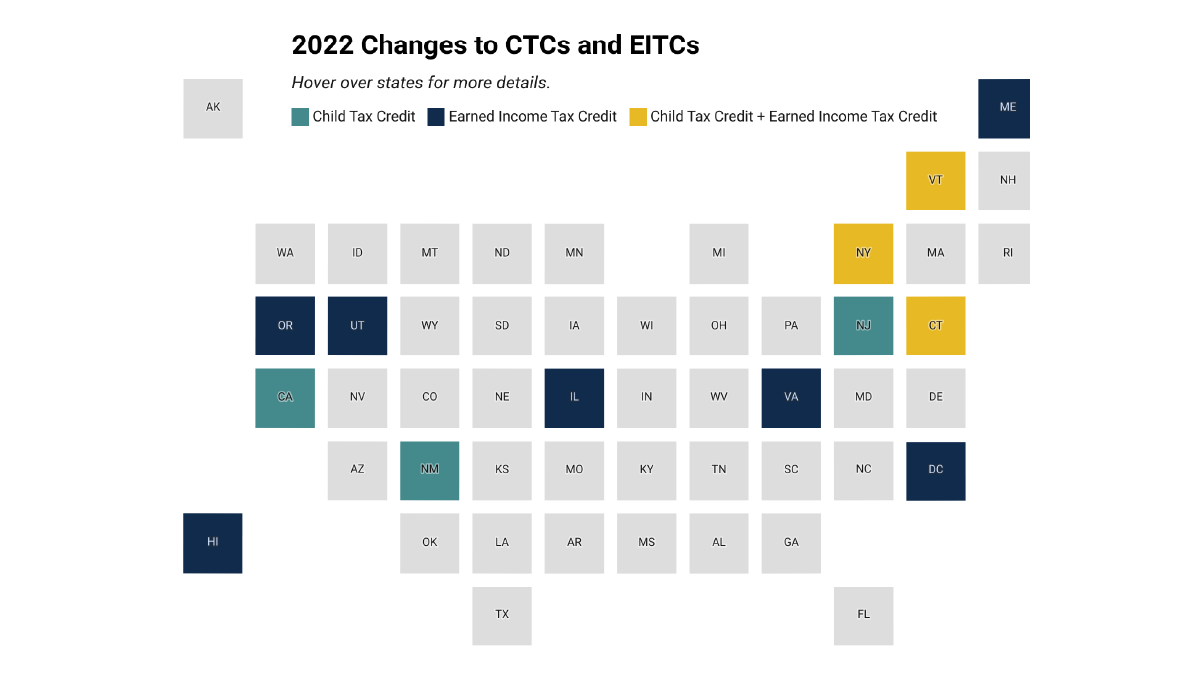

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

2022 Federal State Payroll Tax Rates For Employers

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Providing Broad Based Tax Relief Grant Thornton

Understanding Your Paycheck Http Www Hfcsd Org Webpages Tnassivera News Cfm Subpage 1077 Student Teaching Teaching Activities Understanding Yourself

Federal Tax 175k Salary Example Us Tax Calculator 2022

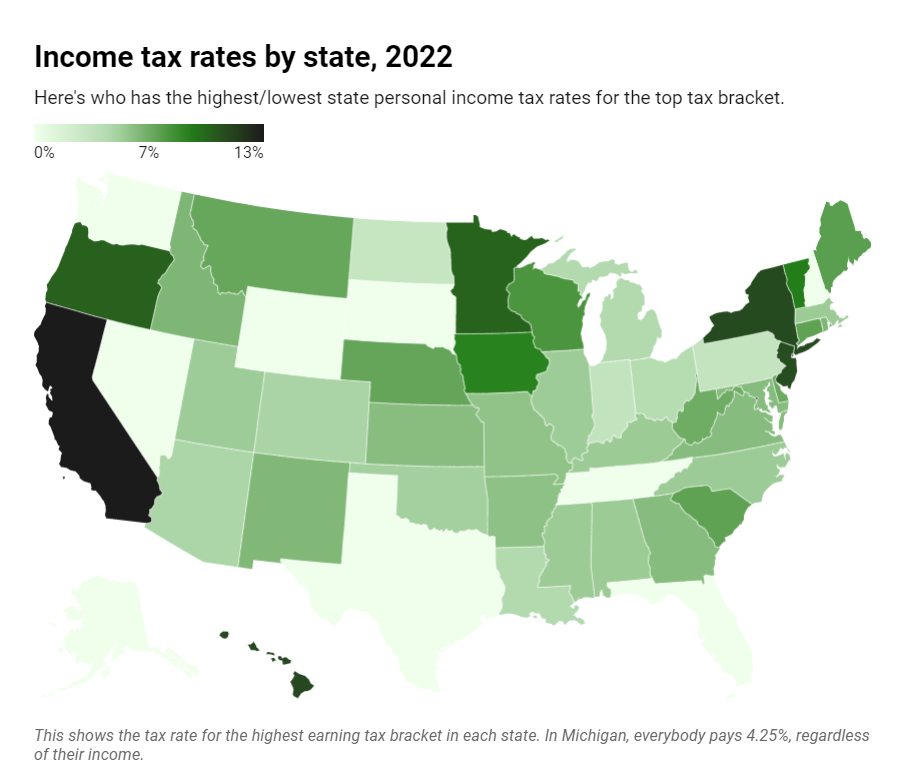

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation